DMC Consultants Limited

|

DMC Consultants Limited |

|

|

|

Tips For Creating A Chart Of Accounts

A chart of accounts is the listing of the individual accounts that make up an accounting system. In accounting software, the information contained in a chart of accounts will normally include the account number, the account description and the account type (e.g. balance sheet). Some programmes will include additional information such as the typical balance and the category (cash, receivables) that the account belongs to. Several factors help to determine the format of a chart of accounts. These include:

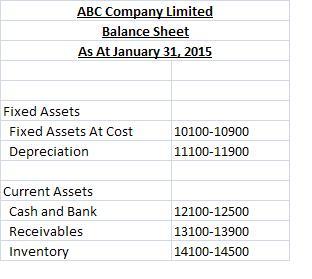

Reporting Requirements One must have a clear understanding of the information that is required before the chart is developed. Are departmental, location or product profitability reports required? Will consolidated group accounts be required? The chart should be designed to meet the organization's reporting requirements. General Ledger report writers pull balances from accounts. The chart of account structure should therefore ensure that the required information is captured in individual accounts or groups of accounts. It is useful to finalize the format of the financial statements before creating the chart. This way, the structure of the chart will match the structure of the reports. This can speed up report printing since related accounts will be grouped together. It is useful to map out the financial statement formats on a spreadsheet. Once the account numbers have been finalized, they can be added to the document and given to the person creating the statements. See the example below.

Organizational Structure A company’s organizational structure can affect a chart of accounts in several ways. It may be important, for example, to know the profitability of individual departments or locations. Account segments provide a useful way to do this. A segment is a section of the account number. An account number such as 10-253-5600 has three segments which are separated by a “-”. Let us assume that we have to prepare a chart of accounts for a chain of department stores located in Kingston, Mandeville and Montego Bay. Given the company’s structure, we need to know the profitability of the chain as a whole. We also need to know the profitability of each location and each department (men’s wear, household products, etc.). We could use an account structure with three segments. The first segment could represent the location, the second could represent the department and the third could represent the main segment (asset, liability, income, expense). Stationery expense for the men’s department in Kingston could be 10-253-5600 while stationery expense for the men’s department in Mandeville could be 20-253-5600. The department and main segments have remained constant but the location code has changed. Similarly, the lunch subsidy account for the men’s department in Kingston could be 10- 253-6000. The main segment (expense) has changed but the location and department are the same. Many report writers allow users to specify segment restrictions at run time so it is easy to generate reports for a single location etc. Nature Of The Transactions Material transactions are those that are large enough or important enough to be tracked and investigated. Some transactions such as newspaper subscriptions are not usually material and do not have to be tracked by themselves. These can be grouped with other similar expenses in a single account. Other expenses such as office rental may be significant enough to be tracked by themselves. It would therefore be useful to create an account just for this expense. Expected Growth of the Organization A chart of accounts should be designed with the future growth of the company in mind. There needs to be enough space to add new accounts and accommodate the diversification into new lines of business. Depending on the size of the segments, it is useful to leave 10 or 100 empty spaces between each account number. This makes it possible to add new accounts as time passes. For example, if your local receivables account is 1600, the next account should be 1610 and not 1601. We use a minimum of 5 digits for the main segment. Less effort is required to maintain the structure of the chart when this is done. Accountants often find that there is no space within the relevant sequence to add a new account. They are forced to add it in some other section of the chart. Eventually, they have a messy structure that is difficult to maintain. We recommend that a control document be prepared. This should list each category of account (cash & bank, accounts payable, income etc.) and the range of account numbers that may be added. Once this document is used whenever an account is added, the structure and logic of the chart can be maintained. It may be useful for the categories on the financial statements to be broken down further. See the example below.

Summary The steps in creating a chart of accounts are as follows:

|

|

|